As every industry is moving towards digitalization, the expectations of customers are increasing, and it is becoming very much tricky for the insurance companies to match with them.

As of today, the insurance sector is facing a lot of challenges when contrasting with the other sectors/industries. When you think about insurance firms, the first thought that comes to everyone’s mind is limited staff, long questionnaires, minimal customer service/support, and lengthy procedures.

To remove all negative barriers from the customer’s point of view, they begin to use digital agents. The insurance sector is investing more in AI compared to the other 12 major industries.

Most of the people are in a predicament that integrating AI to the insurance company is going to replace humans. But, the reality is digital agents are going to supplement the human efforts.

With the rapid increase in technological innovations and several advancements in AI, many enterprises have started to implement Conversational AI to provide better customer experience, process improvement, and product innovation.

At present, you can see a consistent rise in the use of Artificial intelligence in the insurance sector for various purposes, such as fastening the claiming process, coverage personalization, behavioral premium pricing, risk management, product development, underwriting, administrative tasks, and for customer service.

Insurers already started experimenting with conversational artificial intelligence for more than ten years because everyday insurance companies are dealing with 100 of claims requests, 1000 of service requests, and 2000 phone calls from existing and new customers.

In countries like India, the customers will raise queries from more than 8-10 different regional languages. And a company using conventional call centers has to allocate more resources to serve them 24/7, which is very difficult & costly.

For the above problem, there is only a single solution that is the use of conversational AI.

The insurance Chatbot or conversational AI solution will help a customer 24/7, and it can also handle thousands of call/service requests in a single instance.

Also Read: Conversational AI for the Best Customer Engagement

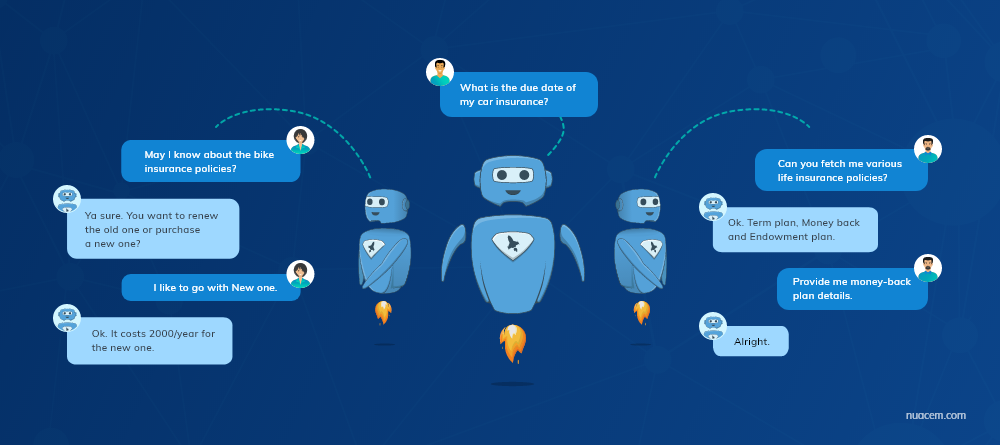

Example:

All the above customer’s raised queries are resolved at the same instance without any further delay with the help of conversational AI.

The digital agents are expected to save more than $174 million across multiple industries like financial services, insurance, and customer service. So, every insurance firm must know the importance & benefits of opting conversational AI solutions.

If you are on the same boat and know about conversational AI solutions for the insurance sector, just follow us.

In this blog, we look at the role of conversational AI in the insurance industry.

Let’s begin!

Why are digital agents failing?

Insurer companies need to overcome various obstacles to success with their digital agent’s implementations.

Many of the conversational AI companies are failing to provide the right digital agents due to the following reasons:

- The lack of understanding in natural human language

- Absence of proper training & briefing

- The agent designed for a single channel

- They built agents based on fundamental interactions

- No chance of scaling their digital agent

So, above are the reasons for most of the failures of digital agents.

Whenever you are going for a digital agent/ virtual assistant, you must evaluate below things.

Scalability

The scalability is the crucial factor one must take care of while developing their digital agent. Most of the companies are developing virtual agents that are capable of handling some particular number of service requests.

It will be ok until the number of requests is under the limit. But, when suddenly it crosses the threshold value, the server will not respond.

It is the typical situation faced by most of the AI Companies, and most of them are not able to deal with them.

But, Nuacem AI has the potential to build scalable virtual assistants or digital agents.

Ability to understand the user intent rightly

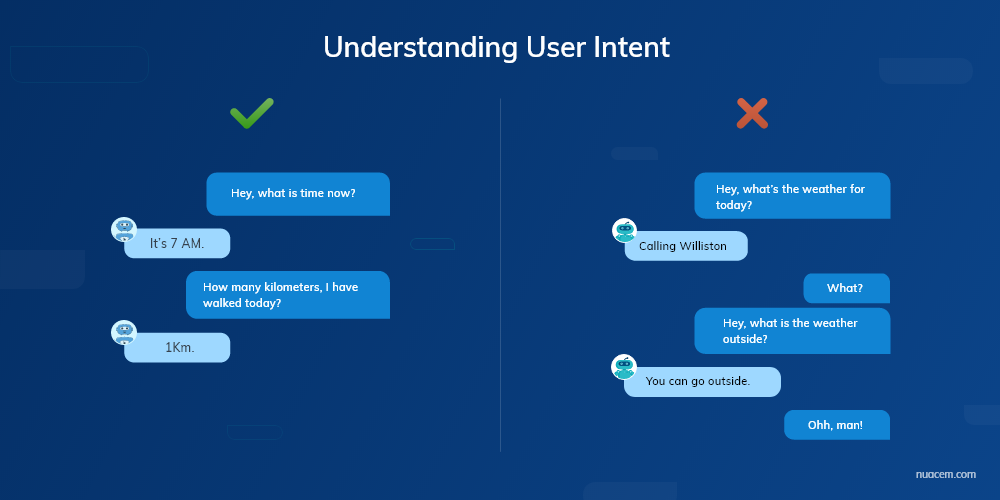

We are all aware that digital agents as they are faster and precise compared to a human agent. The problem is the bot developers are not adequately training them with the right channel information because of which the agents are not able to understand user intent rightly and respond with negative ones.

At Nuacem AI, we take complete care of the training the channel to understand intent users rightly, and we also train them with natural human language.

To give you a better understanding, we will provide you with a simple example of what is right and wrong intent?

Language barriers

As of now, AI, ML, NLU/NLP capabilities of the majority of the platforms are not evolved enough to understand the user input exactly. Most of the companies will say their Chatbots are mature enough to handle language barriers. But, in reality, they are not.

For a standard assistant, it is very much tricky to handle user’s requests and mainly in a country like India where more than 8-10 regional languages are used.

But, At Nuacem AI, we develop bots, which are mature enough to handle requests using natural human language only.

Data privacy & protection

When a user interacts with the digital insurance agents, they will provide their personal and private information. In the current situation, more data breaches are happening with the advancement of technology.

To safeguard the privacy of our customers, at Nuacem AI, we combine enterprise-grade security features with rigorous compliance to industry standards for the protection of user data.

We use various security features like encryption using TLS 1.2 protocols, Multi-factor authentication, server hardening utilizing the center for internet security(CIS), and information security compliance audits.

How is conversational AI benefiting insurers?

More efficiency

By addressing almost all the time consuming & monotonous jobs, the conversational digital agents can help their employees to devour their time economically as well as minimize overall on boarding, staffing, and training costs.

By using digital agents, insurance firms can increase customer capacity support by 150%, and the number of automated interactions increased to 10,000+.

24/7 availability

According to a report, 64% of customers feel that 24/7 customer support is one of the best features of conversational agents.

It is one of the top benefits offered by digital agents. It will clarify customer doubts 24/7 when no other option is available for the customer like customer support and human agents on holidays or weekends.

Better customer engagement

When you are helping a customer to save their hard-earned money, which will help to increase customer loyalty & engagement.

Eventually, if your digital agent is helping in saving money on a regular basis by providing pre-sales information, they will come back to you.

It is very much helpful in increasing customer engagement in the long run.

Supercharging claims

It will be tough to fill up lengthy forms and waiting hours to speak to customer support to claim our insurance.

But, with the help of a conversational AI solution, the claims process will look simpler, faster, and more efficient, and it also decreases fraudulent activities in the organization. The agents will communicate with customers dynamically, and when required, they will transfer the call to human agents.

With the help of conversational AI, we can claim process time will decrease from 72 hours to 3 minutes.

Reduce customer confusion

According to a survey, 72% of customers revealed that insurance firms are using confusing terminology. To remove such things, they need to take the appointment of a human insurance agent or need to call customer service support.

It is a time-consuming process and needs to wait until they answer, and sometimes, even they don’t provide or remove your confusion.

In such cases, conversational AI or digital agents will help in reducing that confusion, or most probably wholly removes it.

The digital agents are helping users to understand confusing terms, by which there is an increase of 45% in customer satisfaction.

Future of the insurance industry by adopting conversational AI

Most of you feel the insurance sector is a complex one, but with new advancements in conversational AI helps in easing out various insurance-related complex problems.

They are looking out to build contextualized and creative products to meet daily evolving user requirements, by which firms are modifying their insurance distribution strategy to take on new offerings to customer needs and the digital technology-led distraction in the market.

Around 80% of the insurance executives believe that Chatbots in insurance/conversational AI will revolutionize how they collect information and the way they interact with the customers.

Don’t be surprised if someone says, conversational AI is going to make rapid changes in the insurance industry in the next five to ten years.

Because, it is on track to alter the insurance sector completely by providing a seamless experience across the front, back, and middle office.

To stand with accelerating changes, the board members and customer service management will have to invest their energy and time to get an in-depth understanding of the AI trends.

Within a few years, everything will be seamless, automatic, and silently connected and by which one can claim their insurance in a minute by taking a photo of their home or car or bike.

The above feature helps to build high trust and bond between users and insurance firms. The speed of change is exceptional, and insurance firms got a clear understanding that adopting conversational AI is the key to survival in this competitive market.

The increase in the esteem is justifiable, and it is also safe to envisage a persistent escalation. Undoubtedly, the landscape of the insurance sector is going to change with the adoption of the conversational AI to their businesses.

Final words

Currently, digital agents are becoming the insurance industry norm, and you have observed tremendous progress by using conversational AI in the insurance sector.

If you want to succeed in this crowded insurance market place, carriers should focus on the daily evolving expectations of the customers. To stand with current customer expectations, one must opt for the conversational AI solution.

If you are still following the traditional processes in your insurance firm, and that is affecting your business model?

Then, it is the right time to automate your business.

Just stay tuned with us!

To feel the future magic of conversational AI.

If you are planning to develop a conversational AI solution for your insurance firm?

If so, Get in touch with us!